7+ Superannuation Late Payment

Made the payment before the date the. It is a legal requirement that superannuation for eligible employees be paid 28 days after the end of each quarter to their nominated superannuation fund.

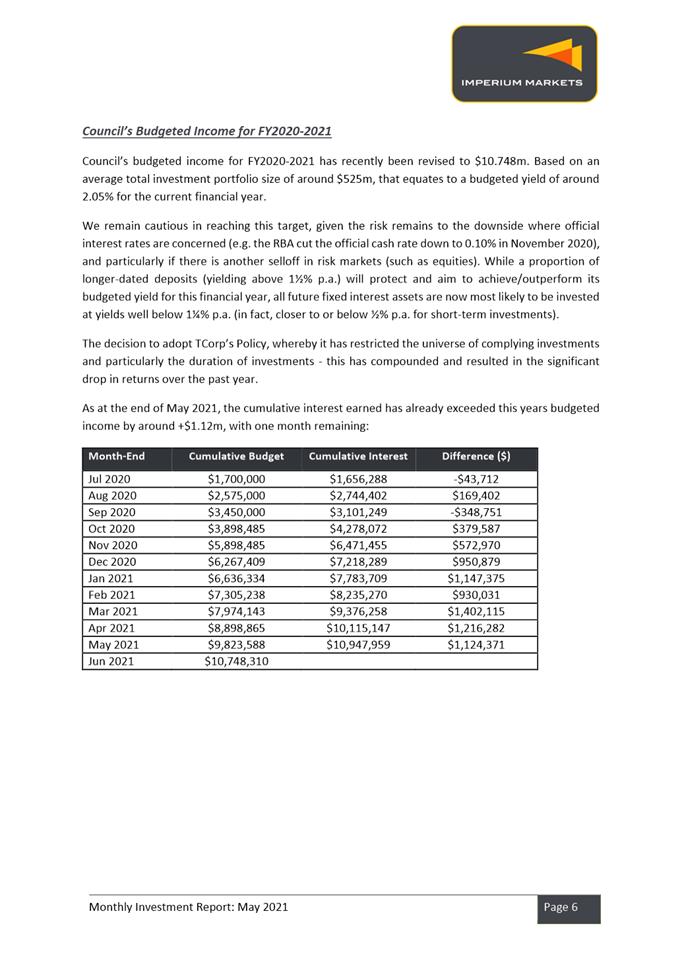

Agenda Of Council Monday 28 June 2021

Web A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added.

. Sometimes your regular pay day will fall on a national holiday. What are the penalties for not paying super or being late. An administration fee of.

General interest charge GIC Additional penalties Fail to provide an SGC statement when required Youre liable for a Part 7 penalty Superannuation Guarantee Administration Act. You may also be liable for an administrative penalty of 20 penalty units. Latest Breaking Superannuation Headlines and Todays News Updates from Australia 7NEWS Superannuation Dud super funds cost.

In most cases you can offset late payment amounts against the SGC if you. When this happens well always make sure you get your payments. Made the payment to your employees super fund.

Select Superannuation as the topic. Except as provided elsewhere in this Agreement all employees will participate in the Municipal Pension Plan according to the terms and conditions contained in the Pension. Massive penalties apply for paying superannuation late Late payment of super can lead to penalties equal to 200 of the amount of superannuation payable.

What are the penalties for not paying super or being late. In that case you must lodge the superannuation guarantee charge SGC statement and pay the SGC to the Australian Taxation Office. To advise of late payment dates.

If it is paid late you must lodge a Superannuation Guarantee Charge SGC statement with the correct. If youve just realised youve missed a payment or paid the wrong amount were here to help get you back on track. Select Other as the subject.

If you miss a payment or it clears into the fund late the first thing you need to do is prepare or have your bookkeeper or tax agent prepare a Superannuation Guarantee Charge Statement. 7 Superannuation Late Payment Jumat 09 Desember 2022 Edit. If you are unable to lodge through Online services for business phone us on 13 10 20 for other options.

NZ Super and Veterans Pension payment dates for 2022. The shortfall amount the contributions not paid or paid late interest of 10 per annum and. Attach evidence of the late payments in a separate secure mail message.

As an employer you must make super payments for.

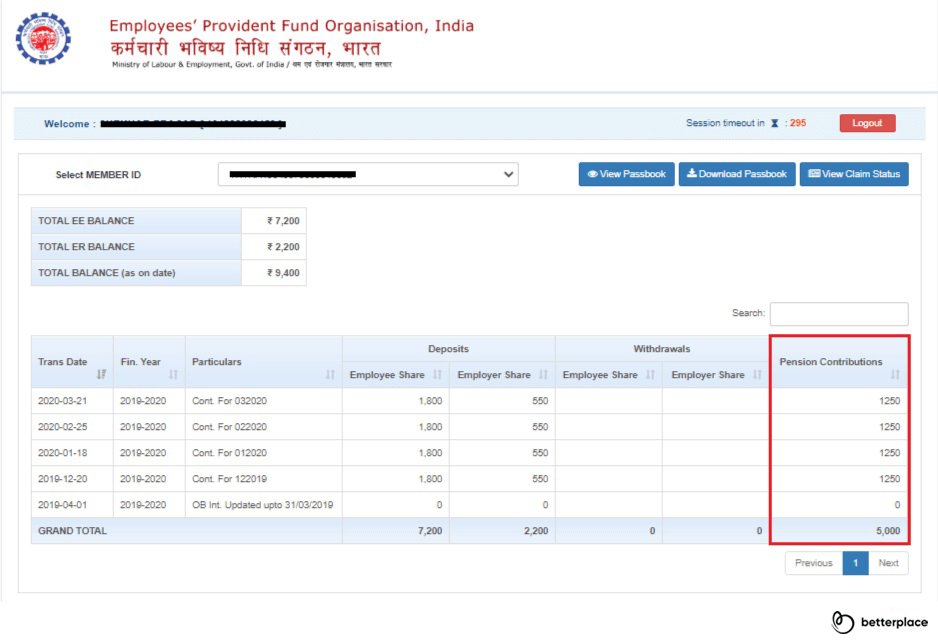

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Class Actions What You Need To Know Shine Lawyers

Sei China 2013 Preview

How To Deal With Late Payment Small Business Uk

Massive Penalties Apply For Paying Superannuation Late Nexia Edwards Marshall

4 Questions We Hear About Late Superannuation Payments Link Advisors

Young Adults Superannuation Ppt Download

Penalties For Late Superannuation Payments And Not Paying Super Twusuper

What Happens If You Don T Pay Your Super On Time Optimised Accounting Werribee Vic

Buy Lego Vidiyo Candy Mermaid Beatbox At Mighty Ape Nz

The Rent Service Annual Report 2007 8

Income Tax Slab Budget 2022 Income Tax Slabs For Fy 2022 23 In India The Economic Times

Missed A Super Guarantee Payment For Your Employees Here S What You Ll Have To Do Pears Chartered Accountants

Pdf Soldiers And Equestrian Rank In The Third Century A D Caillan Davenport Academia Edu

Pdf A Study Of The Health Of Older Adults In The Transition From Work To Retirement Brendan Stevenson Academia Edu

Late Superannuation Payments Can Be Costly And The Ato Now Has Real Time Access To Your Mistakes Pitcher Partners

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1944 Session I Public Accounts For The Financial Year 1943 1944